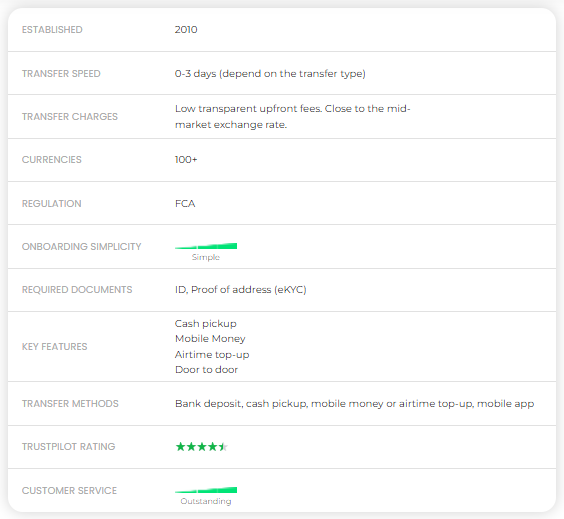

Company Information

WorldRemit is a respected international money transfer company. As its name suggests, the company is focused on global remittances. Based in Denver, Colorado, this online money transfer company offers services to senders across 150 countries, with 145+ receiving destinations in the Americas, Australia, Asia, Africa, and continental Europe. The purpose of this company is to facilitate small and medium international money transfers between friends, family, and acquaintances in foreign countries. All of this can be accomplished by simply using a PC, Mac, iOS or Android device — a web or a mobile App version.

The company’s founder, Ismail Ahmed happened upon this concept while he was studying at a UK University. He wanted to transfer funds back to his native country in Africa but found many problems with bank transfers. Besides for poor customer service, lengthy wait times and mounds of paperwork, the costs of bank transfers were simply untenable.

Fast-forward to 2010 – the year that WorldRemit was born.

Ahmed envisioned a low-cost, convenient money transfer service that acts in direct competition to High Street Banks. Senders and receivers can easily transfer/receive funds across international borders through bank deposits or cash pickup. Other options include mobile airtime top-ups and mobile money transfers. The technological advancements and enhancements offered by this company ensure that it is easier than ever to send money across borders, without having to complete registration forms and transfer documents. The entire process at WorldRemit is conducted online, usually with mobile devices.

By 2015, the company had managed to secure a $140 million of venture investments and became a member of TechCity UK’s prestigious FutureFifty. Despite this massive growth, no expense has been spared in delivering top-tier customer service and low-cost money transfers, resulting in over 3,000,000 happy customers and counting.

How WorldRemit Works

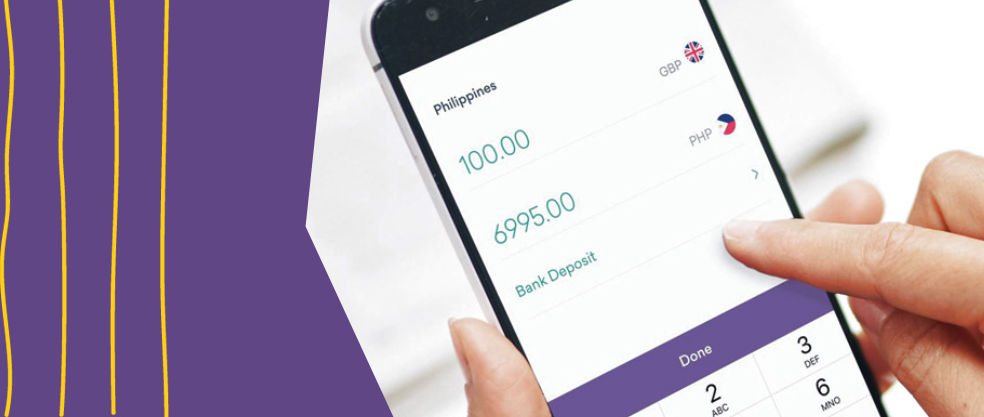

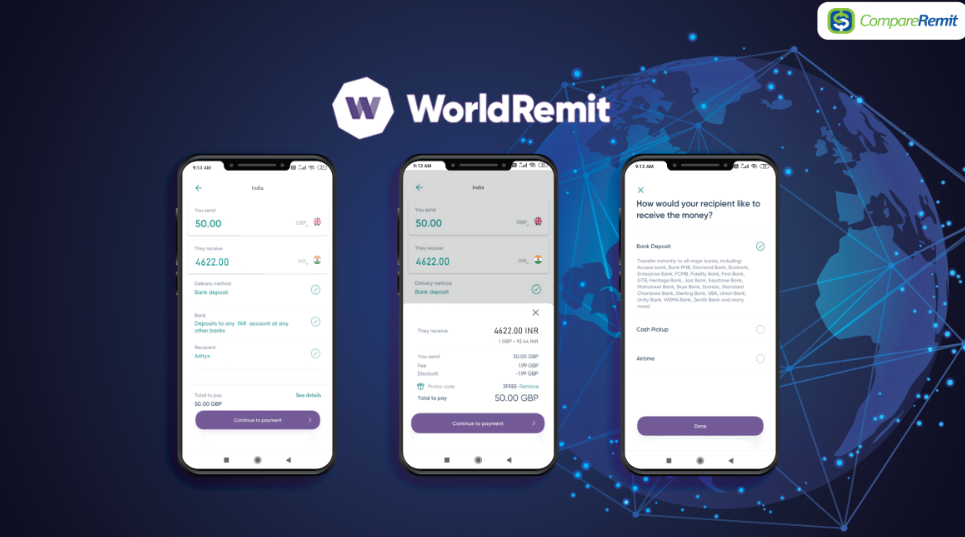

The process of sending money through WorldRemit is pretty straightforward. For starters, customers must select their country/region, and then proceed to the next section which focuses on where the money is being sent. You can send to hundreds of countries around the world, and you can also choose the type of service you are seeking. These include options like cash pickup, airtime, or bank transfers. If you choose the airtime option, you will be required to send the recharge to the mobile telephone number, and then confirm that number to submit the transaction for processing.

Each country that you are sending money to has a listing of payment processing options. These will displayed once you have made your selections online. Fortunately, you will always be aware of the Forex exchange rates, and the fees associated with these international money transfers. SMS notification and an email confirmation will provided to the sender and receiver once the money sent/received accordingly.

How Much Does it Cost?

The transfer fees depend on the method you’re using to send money abroad. When you use a debit card, there are no additional fees other than those that made available to you at the time you’re processing the transaction. Foreign-exchange fees may be levied if you’re using an out of country card for the money transfer. Most types of prepaid cards, credit cards, and debit cards accepted, including all Visa and MasterCard, UnionPay, American Express, and Diners Club Credit Cards.

The big plus is there are no hidden charges whatsoever: the transaction fee, exchange rate, and the final total cost are being calculated and shown to you upfront as soon as you fill the transfer details in the built-in calculator: sending and receiving locations, amount, currency and the transfer method. In our tests, the average transaction fee when sending from the UK, for example, is from £1 to £5, depending on the receiving country and delivery method. The exchange rate used by WorldRemit, while naturally being bigger than the interbank rate you can find on Google or XE, still looks good, comparing to the major high street banks’ rates.

Transfer Speed

The delivery times for WorldRemit depend on the transfer type. The following availability has been noted:

- Home Delivery – 24 hours up to 7 days depending on the receiver’s location

- Mobile Money Transfers WorldRemit Wallet – these funds are available instantly, or near instantly

- Airtime Top Ups – instantly or near instantly

- Cash Pickups – these funds are available instantly

- Bank Transfers – certain banks allow for instant transfers and availability, others will depend on when the transaction was generated, what day of the week, and the specific bank in question.

*The expected delivery time will be displayed to you before you make a payment.

Is WorldRemit safe and reliable?

Security and privacy information is provided on-site. This remittance company fully licensed and regulated in the United Kingdom, under the FCA (Financial Conduct Authority). This payment processing company works with many other regulatory bodies to ensure the seamless flow of funds abroad. The website is SSL secure (secure socket layer), and all transactions are verified by way of ID documentation. Firewall protection ensures that no third parties can access your information online. The privacy policy provides details of how client information used and shared (if applicable).

Pros

- Low costs incurred in transferring funds

- Friend referral bonuses available to clients

- Fully licensed and regulated by the FCA of the UK

- Flexible Payment Options: credit/debit cards, bank transfer and others

- Customer service available 24/7 in 6 different languages

Cons

- Not all countries covered by WorldRemit services

- Transfer limit: max of $9k in 24 hours and $5k per transaction

Does WorldRemit fit your needs?

With WorldRemit you can send money from 50+ to over 150 countries around the world in Africa, the Americas, Asia, Australia-New Zealand, Europe, and the Middle East.

WorldRemit preferred by customers for 4 major reasons: it provides a simple and effective way to process remittances internationally. Since it’s available 24/7, it is easy to make international payments at the click of a button. The low-cost nature of the services provided by WorldRemit is another feather in its cap. The fees and exchange rates are all provided upfront, so there are no nasty surprises for customers. Once the transfer processed, money receivable within minutes. Transactions processing takes place rapidly, sans the lengthy delays that typically associated with bank transfers. Perhaps the biggest selling point is the customer satisfaction evident on objective review sites. To date, WorldRemit has a 5-star rating on TrustPilot with 85% of the reviewers giving it an excellent rating.

There are multiple ways of receiving funds through WorldRemit, notably cash pickup, bank transfers, mobile money, airtime top-up, door to door payments, and prepaid card options.

- Airtime Top-Up means credit, which added to a mobile phone account. Which can be used to make calls, send text or picture messages and use data, that is purchased by the Sender and credited to the Payee’s mobile phone account typically within a few seconds.

- Mobile money an electronic wallet service. This is available in many countries and allows users to store, send, and receive money using their mobile phone. The safe and easy electronic payments make Mobile money a popular alternative to bank accounts. It can used on both smartphones and basic feature phones. Most mobile money services allow users to purchase items in shops or online, pay bills, school fees, and top-up mobile airtime. Cash withdrawals can also carried out at authorized agents.

- Door-to-door delivery a service where physical cash delivered to your recipient’s home address. Your recipient must present a valid ID that matches the details of the transaction to receive the cash. It is therefore important that you enter the recipient’s details accurately.

Since this international company offers money transfers worldwide, the receiving options will vary based on the country you’re sending to. It also depends on where you are sending money from.

To fund the transfer, the payer has even more options available:

- Card (debit, credit and prepaid)

- Bank Transfer

- Poli

- Interac

- iDEAL

- ACH

- Sofort

- Android Pay

- Apple Pay

- Trustly

The payment options for your transfer depend on your send country and vary from location to location.

Which Countries Can I Send Money From with WorldRemit?

WorldRemit onboards customers from over 50 countries around the world, including:

- Africa: South Africa and Somaliland

- Americas: United States, Canada, and Brazil

- Asia: Hong Kong, Japan, the Philippines, Singapore, South Korea, Taiwan

- Australia & Oceania: Australia, New Zealand, Guam

- Europe: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland and the United Kingdom

- Middle East: Bahrain, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates

With WorldRemit you can send money online to 140+ countries.

Registration and Onboarding

As a financially regulated company, WorldRemit required by law to verify its customers. This is part of the KYC (Know Your Customer) process. Part of this process is identity verification. Typically this involves collecting a copy of government-issued ID from the sender. Most of the time the customers’ verification done automatically and fully online in the “eKYC” manner so you won’t need to send any paperwork. You can upload your ID securely at any time into your account or alternatively emailing the WorldRemit Customer Service team.

The type of verification they will need can be different depending on the amount that you are sending, and which country you are sending from. This is because each country you can send from will have different laws that WorldRemit need to abide by.

Usually, users only required to provide the name, address, and date of birth. However, in some circumstances, WorldRemit may also require further information in order to comply with the regulatory obligations. This can include the transfer purpose or source of funds for example.

Customer Support

Customer support is available by clicking on the help & support option. Customers can access support via multiple channels including the FAQ, contact us, and social media channels on Facebook, Twitter, and LinkedIn. The “contact us” button directs you to an email address – [email protected]. The FAQ section is equally useful since it provides stock answers to a wide range of questions that customers have about sending and receiving money.

There is also a list of phone support numbers available for different locations.

Bottom Line

WorldRemit offers a cost-effective, reliable and rapid money transfer service for the folks. This company specializes in remittances for clients around the world and has disrupted the market with the user-oriented product and very thought-through solutions, specifically created with the transfer receivers from the developing countries in mind. Multiple send/receive options are available, including phone top-ups, mobile money, cash pickups, and even door-to-door delivery options, in addition to regular bank transfers.

While access to the account offered through the IOS and Android mobile Apps in addition to the web version. All in all seems like a great combination of fair price, customer-oriented products, easy and handy sending and collecting options both for the payer and the payee. No doubt the company is serving over 1 000 000 transfers monthly across the globe — very appealing solution for the remittance needs indeed.