About H&R Block

Founded in 1955 by Brothers Henry and Richard Bloch, H&R Block has grown to become one of the leading tax services companies, having prepared more than 800 million tax returns in its lifetime. In 2019, the company reported having prepared one in seven U.S. tax returns through its brick-and-mortar offices and tax software.

The brand often touts its availability for professional, in-person tax support. It employs more than 80,000 tax professionals, many of whom are bilingual. The company says that its tax professionals must have at least 60 hours of training and pass a six-level certification program and that a typical H&R Block customer will be helped by someone with about 12 years of experience. These tax pros are available online and in H&R Block’s many retail locations; with about 11,000 retail offices across all 50 states, U.S. territories, and U.S. military bases around the world. This means that, on average, there is an H&R Block located within five miles of most Americans.

With the COVID-19 pandemic, H&R’s Block’s selling point of in-office professional tax preparation might not be as much of a boon, so the company has made changes to its process. You can still go into an H&R Block office and meet with a tax preparation specialist at a safe distance. H&R Block has also added a Drop-Off service and a Virtual Drop-Off service for no-contact tax help.

Aside from its one-on-one support, H&R Block also offers a variety of tax products for taxpayers who don’t want the extra help. There are four levels of tax software available from H&R Block, each of which is also available for downloadable purchase. You can also elect to have a tax professional assist you as you file online, with four levels of online tax software available with an Assist option.

H&R Block Review

3.8 U.S. News Rating

Ranked #2 in Best Tax Software of 2022

Ranked #2 in Best Tax Mobile Apps 2022

Best for:

- People with simple returns looking for free tax software

- People who want lots of filing options

- People who want live support from tax pros

Not recommended for:

- People who have complex tax returns but want a cheap option

H&R Block is a large tax preparation company with options for do-it-yourself online and desktop tax software as well as full-service, in-person tax prep and support. You may recognize H&R Block from its many locations around the United States, which gives it a leg up against competitors who only offer digital and remote services.

If you’re comfortable with computers, the best way to file your taxes is likely do-it-yourself with H&R Block’s online software. Households with low incomes or very basic filing needs can take advantage of free options to file. However, anyone with common needs such as itemized deductions, health savings account (HSA) contributions, or investments will need to upgrade to a paid version, starting at $49.99 plus $36.99 per state. H&R Block online should meet the needs of those with even more complex situations, including self-employment income, rental property income, and cryptocurrency sales. The MyBlock mobile app is useful for getting started and uploading files, but you may want a computer to finish your return in most cases.

If you’re midway through filing and decide you need more help, or just want to start with the assistance of a tax professional, H&R Block offers both online and in-person options starting at $69.99 plus a per-state charge. You can upload your documents for a completely virtual experience, meet with a tax pro in person at one of 9,000 office locations (walk-in or appointment), or drop off your files at an office and let someone else handle everything.

H&R Block handles nearly all tax situations with just a few limitations. Like other major tax software and preparation services, it also comes with a maximum refund guarantee.

While it’s not quite as slick when it comes to graphics and the overall flow of your tax entry experience compared to some other options, it does a very good job of including everything you need to get your taxes done efficiently with accurate results and a reasonable cost. The option to switch between preparation methods, including in-person help in an H&R Block office, is an offering that meets the needs of a wide range of taxpayers.

Products Offered by H&R Block

H&R Block products are available online, or they can be downloaded or purchased on a CD as software.

Online Products

Free Online: $0 + $0 per state filed

The Free version may be an option if you have a relatively simple filing situation. It’s ideal for those who have W-2 income, kids, and rent, as well as for students and first-time filers. H&R Block Free Online includes one free federal and one state e-filed return, an easy-to-use help center, and free technical support via online chat and phone.

Deluxe Online: $49.99 + $36.99 per state filed

If you’re a homeowner, make charitable donations and/or have a HSA, Deluxe may make sense for you. It allows you to store six years’ worth of tax returns, access to Deduction Pro to optimize deductions, and provides chat support for technical question

Premium Online: $69.99 + $36.99 per state filed

Premium is likely the best fit for you if you’re a freelancer, contractor, investor, or rental property owner. With this package, you can enjoy all the Deluxe features plus the ability to import expenses from popular expense-tracking apps and conduct cost basis calculations with H&R Block’s advanced filing calculators. Cost basis calculations can help you determine the cost basis of your home sale as well as dividends, gifts, and inheritance assets. This version includes support for investments, including cryptocurrencies.

Self-Employed Online: $109.99 + $36.99 per state filed

Self-Employed is a smart choice if you’re a self-employed individual or small business owner with a home office and/or employees. It includes all Premium features as well as an improved guided Schedule C interview.

For an additional fee, H&R Block’s Online Assist service can be added to any of its online tax software programs. This service provides on-demand help from a tax expert, enrolled agent, or CPA.

Online Assist

Basic Online Assist: $69.99 + $0 per state filed

The Online Assist options from H&R Block are similar to its Online products but allow you to get on-demand help from a tax professional through a chat feature with screen-share abilities, or by phone, if you prefer. The Basic Online Assist edition is good if you have a relatively simple return but want a bit of extra help to walk you through the software.

Deluxe Online Assist: $109.99 + $36.99 per state filed

Deluxe Online Assist has the same features as the Basic Online Assist version, but includes support for tax situations like real estate taxes, home mortgage interest, and charitable donations, plus additional technical features like the ability to import last year’s return if you previously used H&R Block and live tech support.

Premium Online Assist: $159.99 + $36.99 per state filed

Premium Online Assist is similar to the Deluxe Online Assist version, but it also allows for income from stocks, bonds, and rental properties, plus certain business deductions.

Self-Employed Online Assist: $194.99 + $36.99 per state filed

Self-Employed Online Assist is designed for small-business owners looking for a way to file their tax returns online but may want some virtual help from a tax professional. It includes all the features of Premium Online Assist plus the ability to claim business expenses, report business deductions, and import expenses and information from Stride and Uber.

Software Products

Basic Tax Software: $29.95 + $39.95 per state program + $19.95 per state e-file

If you like the idea of using software to do your taxes and have a straightforward federal tax return, the Basic is the way to go.

Deluxe Tax Software: $44.95 + $39.95 per state program + $19.95 per state e-file

The Deluxe should be on your radar if you’re a homeowner or investor who prefers a software product rather than an online version. If you have mortgage interest, real estate taxes, stock sales income, capital gains, investment property sales, or a child’s investment income, this product is for you.

Deluxe + State Tax Software: $54.95 plus fees for additional states

Deluxe + State is just like the Deluxe software but adds the capability to do your state taxes.

Premium Tax Software: $74.95 plus fees for additional states

If you have complex federal and state returns to complete and want to use software, Premium has you covered. It can handle things like self-employment income and expenses, rental property income, estate and trust income, depreciation, and sale, dividend, gift, and inheritance cost basis.

Premium & Business Tax Software: $89.95 + $19.95 per state e-file

Premium & Business is designed for you if you’re a small business owner with 10 or more itemized expenses. It can handle returns for C corporations, S corporations, partnerships, LLCs, estates and trusts, and nonprofits. Payroll and employer forms are also included.

In-Person Options

$80+

In our unbiased analysis to determine our rating of the Best Tax Software of 2022, we focused solely on H&R Block’s software products, not its in-person services. However, if none of these options are right for you, you can still get one-on-one help the old-fashioned way through H&R Block. The company is still offering its traditional in-person services, though with some changes due to the coronavirus pandemic. You can go to a retail office and meet with a tax professional at a safe distance. Safety measures may differ between individual offices due to state and local mandates, so check with your local office first.

H&R Block also has a Drop-Off service. You can bring your tax documents to a retail location and meet with a tax professional for a 15-minute consultation or simply leave your materials and they’ll handle the rest. You can also do a Digital Drop-Off by uploading your documents without having to leave your home.

All of these services start at $80 and vary depending on your specific tax prep needs.

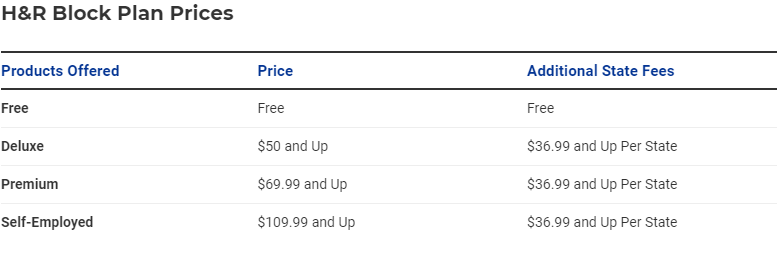

How Much Does H&R Block Cost?

H&R Block can cost more than $140 for its more robust filing options, making Block-branded products among the more expensive mainstream tax filing software options. It’s not the most expensive around, but it ranks near the top of the list. However, you may find that cost worthwhile when it comes to something as important as your taxes. Because you don’t have to pay until you file with online versions, you can start with H&R Block for free and kick the tires before deciding whether or not it’s worth paying.

The in-office and virtual tax pro options cost more, which makes sense considering you’re getting a higher level of service. H&R Block offers reasonable prices for assistance when working with a human tax preparer.