Taxes are hard enough to do even with top-notch tax preparation software, so the more choices you have for getting them done, the better. H&R Block provides more options for personal tax preparation than any of its competitors, including in-office services, DIY software, online applications, and numerous options for virtual expert help. We focus mainly on H&R Block Deluxe, which focuses on income from W-2s and interest/dividends, and supports Schedule A, so you can see whether itemizing is better than taking the standard deduction.

H&R Block Deluxe offers an exceptionally capable blend of tax topic coverage, usability, and taxpayer guidance, all of which earned it an Editors’ Choice award for online tax preparation services three years ago. It’s still one of the very best tax prep websites—second only to TurboTax, our Editors’ Choice winner this year.

The company has introduced numerous enhancements to its 2022 software (which you’ll use to file your 2021 taxes) that help provide a better user experience and minimize errors, confusion, and frustration. It has overhauled several crucial topics, including the earned income credit (EITC), child tax credit (CTC), and Schedule C. You will now be able to report individual cryptocurrency sales, and it’s easier to understand state residency rules. The topic area hubs (homepages for income, deductions, and so on) have been redesigned to accelerate and simplify tax data entry. H&R Block also continues to support its integration with Wave, a free small business accounting service the company acquired that won a PCMag Editors’ Choice a few years ago.

Like an Office Visit

If you’ve ever sat in a tax preparer’s office, you’ve probably noticed they know what questions to ask and in what order. Online personal tax preparation websites like H&R Block Deluxe work similarly, minus the human interaction. You don’t see graphical representations of tax forms as you work. Rather, these sites use wizard-like tools to display their questions. When you supply an answer, the website works in the background to do the required calculations and fill in the official IRS forms and schedules.

As you advance through the wizard, you can track your progress through both occasional summaries of your work so far and real-time dollar figures representing what you owe or are owed at that point in the process. Help is available in a variety of ways. If you don’t understand a particular query, you can click links for more detailed explanations. The best services never expose you to the sometimes-complex language the IRS uses in its instructions. Instead, their tax experts rewrite the official texts with the average taxpayer in mind.

As you advance through the wizard, you can track your progress through both occasional summaries of your work so far and real-time dollar figures representing what you owe or are owed at that point in the process. Help is available in a variety of ways. If you don’t understand a particular query, you can click links for more detailed explanations. The best services never expose you to the sometimes-complex language the IRS uses in its instructions. Instead, their tax experts rewrite the official texts with the average taxpayer in mind.

After you exhaust all the topics that apply to your financial situation, these websites do three things. They review your return and show you any problems they found, which you can correct. They transfer applicable data to any state returns you must file. They also walk you through the process of e-filing or printing your return. You can do everything up to this final step without paying the fees required.

How Much Does H&R Block Cost?

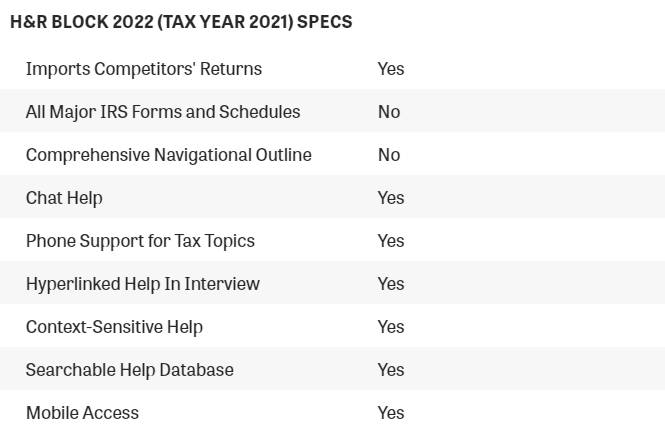

There are four services in H&R Block’s main lineup. Free Online (both federal and state) supports the Form 1040 and situations like W-2 income, dependents, student expenses, and retirement plan income, as well as the Earned Income Credit (EITC) and the Child Tax Credit (CTC). Deluxe Online ($49.99 federal and $36.99 per state) adds numerous features, including the option to itemize, technical support, self-employed income with no expenses, and the ability to organize and store your tax returns for up to six years. Premium Online ($69.99 federal and $36.99 per state) adds Schedule D, E, and F. Self-Employed Online ($109.99 federal and $36.99 per state) adds Schedule C and additional guidance for the self-employed. As of this writing, H&R Block is offering discounts on its online tax prep services. Deluxe, for example, is $29.99. In the past, prices have increased closer to the filing deadline.

There are numerous add-on services that allow various ways to access expert help from tax professionals (CPAs, EAs, and H&R Block agents). TaxPro Review ($59.99 for Deluxe), for example, is just what it sounds like. You complete your return, and an H&R Block tax professional reviews, signs, and e-files it for you. Online Assist ($40 if added on to Deluxe) offers unlimited, on-demand help via chat, call, and screen-sharing on any device. TurboTax offers similar services, albeit at higher prices.

H&R Block’s prices are lower than those of TurboTax across the board. But there are even lower priced options. TaxSlayer’s $17 Classic plan is rather affordable. Cash App Taxes (formerly Credit Karma Tax, now owned by Block, Inc., formerly Square, Inc.) offers completely free federal and state filing, and FreeTaxUSA is free for federal filing and $14.99 per state. Note, however, that with the free services you sacrifice quite a bit when it comes to handholding, which most of us end up needing at some point during the process. That said, FreeTaxUSA has upgraded its help resources for 2022.

Tax prep services often change their prices throughout the tax season, and they tend to go up the closer you get to the filing cutoff date—a good reason not to be a last-minute e-filer. You may even get different prices for some services based on how you reach them online. The prices detailed here are the list prices. You may get a better price if you file early.

Tax Prep Housekeeping

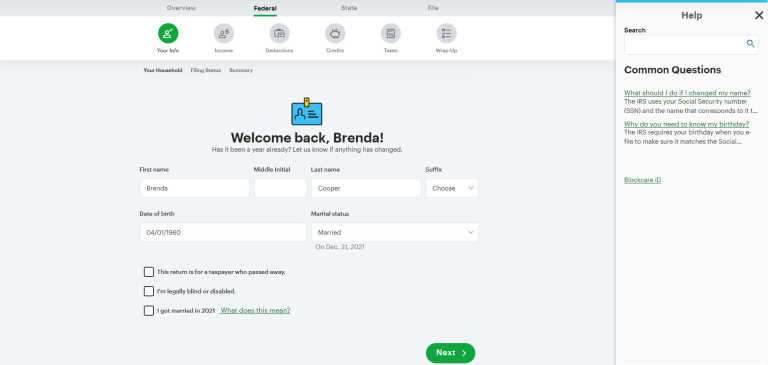

Before you create an account on the H&R Block site, you’re asked to designate the version you’ll use. You can get help making this decision. Once you’ve satisfied the site’s security requirements, you’ll move through a lengthy series of pages, supplying personal information about you and your family. This information includes names, addresses, birthdates, and Social Security numbers for everyone in your household who will be included on your return.

If you filed using H&R Block last year, that information should transfer automatically to the present. You can also import data from major competing websites like TurboTax and TaxAct.

Other screens ask for answers to questions about, for example, your filing status, citizenship status, and residency. When you’ve completed this section, the site provides a summary for you to check and edit if necessary.

Income First

If you’re using H&R Block Deluxe, you’re likely to have income that was reported on a W-2 form. That’s the first income-related question the site asks about. There are four ways to provide this information. You can upload a PDF, take a picture of it with your smartphone after H&R Block texts you a link to a secure site, or fill in the fields manually. The site can also import W-2 data directly from many employers.

Once you’ve finished with any W-2s, you answer a few more questions. One asks if you acquired, sold, sent, or traded any cryptocurrency. If you say yes, you’re told you have to upgrade to Premium. If you do so, you’ll be able to enter any cryptocurrency movement as individual transactions.

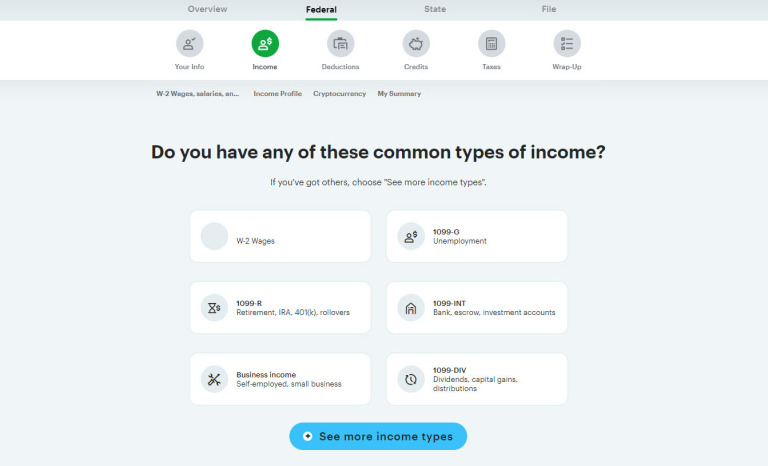

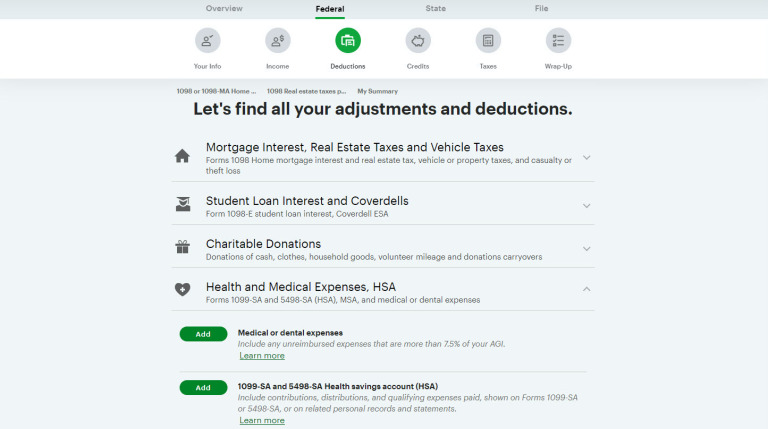

Click Add income, and the site displays one of its nicely redesigned hubs. These hubs are something like homepages for the site’s main categories, like income. They list all the topics in those areas, no matter which version you’re using. If you’re using the Deluxe version, you’ll see entries for Business and Partnerships, even though they aren’t covered by Deluxe. If you choose a topic only available in a more expensive version of H&R Block, you’ll be asked if you want to upgrade. You can, however, provide information about your income, such as interest and dividends, Social Security, and 1099-R retirement distributions. H&R Block Deluxe lets you connect directly to many financial institutions to import this data, which saves time and ensures accuracy.

To visit a specific topic (like Interest, Dividends, and Capital Gains Distributions), you click the down arrow to the right, which opens the list of subtopics covered there. Each subtopic has an Add button next to it. Click it and a mini-wizard walks you through the Q&A for that tax item. You provide the information requested by clicking buttons to indicate the correct answer, entering information in fields, and selecting from lists of options.

When you finish, H&R Block Deluxe opens a screen that recaps your activity up to that point. It displays a list of every topic you’ve visited and lets you revisit or delete any of them. At the bottom of the page, you can click the Add Income button to indicate you must return to the income page to visit more topics, or the Next button to see a summary of your responses (with your 2020 numbers for comparison) and move on to adjustments and deductions. Other services, like TaxSlayer, work similarly.

The rest of the tax preparation portion of the service functions the same way. H&R Block Deluxe presents a list of topics you might want to visit based on what it knows about you but gives you the option to visit others. After you’ve completed the Deductions section, you move on to Credits and Taxes, and finally, the Wrap-Up, where you see a summary of your return and can go back to make changes. The site then transfers relevant data over to your state return and runs a review for it before you pay and file.

The H&R Block User Experience

Navigation is simple and straightforward. You advance from screen to screen by clicking the Back and Next buttons. You can also, for example, click a tab in the horizontal toolbar at the top (Overview, Federal, and so on) to see its subsections (like Income, Deductions, and Credits). Directly below is a list of the forms you’ve completed, and selecting one takes you back to it. Links in the left vertical pane show your real-time, ever-updating tax obligation or refund and take you to housekeeping pages, such as Previous Taxes and Account Settings.

H&R Block Deluxe makes it clear on each page what action you need to take and where you need to go next. But it lacks a comprehensive navigation tool like the one FreeTaxUSA offers. It also feels choppier than TurboTax Deluxe. Even on some screens where you’re just clicking Yes or No options, you still have to click the Next button to advance. That adds up to a lot of extra clicks.

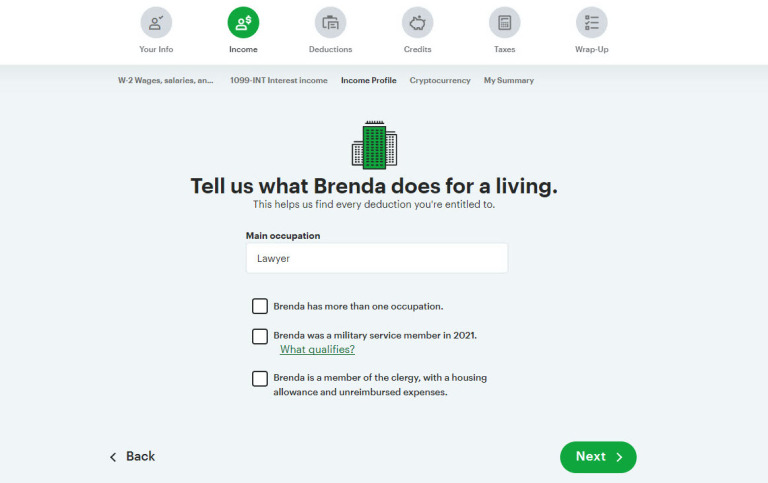

H&R Block is a little more formal in its language and looks than the friendly—even folksy—TurboTax. The two sites have different personalities. TurboTax is like the human preparer who greets you with a big smile and makes small talk as they go along. H&R Block is a bit more busi-nesslike, though it has its own welcoming brand of personal interaction. Both are effective ap-proaches.

I encountered one performance issue on the site. A few times when a screen was supposed to advance, it just hung, with a “Saving” message. I eventually refreshed the page and didn’t appear to lose any data, but it made me nervous.

Handy Help

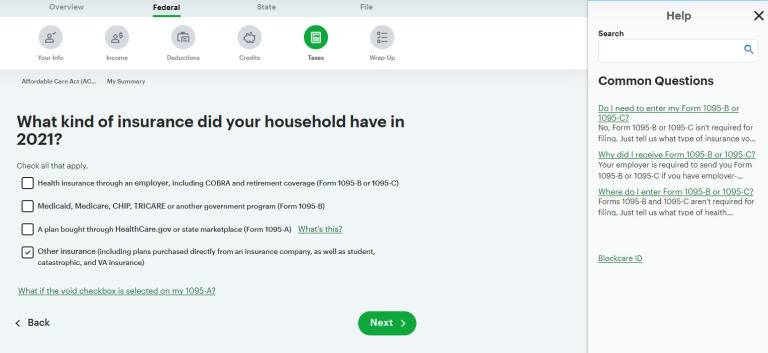

The Q&A format online tax preparation solutions use works well if there’s always an option to have complex or unfamiliar concepts explained in more detail—without requiring you to open a giant help database and search for a term (though there’s a place for that, too). It’s critical for tax software to make context-sensitive help easily accessible.

H&R Block Deluxe does an exceptional job here. Previously, it used pop-ups with explanations of hyperlinked words and phrases (TurboTax still does in many cases). Now, it reserves the right vertical pane for help. The pane can be toggled on and off, and it doesn’t obscure the working area of the screen as it did before. It’s always there, to the right, and it usually shows you content-sensitive FAQs and other guidance for the current page. TurboTax does something similar, but it doesn’t automatically change the help window to match each topic like H&R Block does.

The difference is huge. In H&R Block, help related to the current screen is automatically there. In TurboTax, you have to ask for it. A concrete example is the home mortgage section. The site explains on the first page what it’s looking for and displays a hyperlinked What’s a Second Home? phrase. Click on it, and the answer is spelled out for you in clear, understandable language in the right pane. At any point, you can also enter a word or phrase in the Search field of the right pane; you may have to open it by clicking the help link on the main screen or the question mark icon in the upper right.

Enter a word, like “energy,” and several suggested topics will appear, like Energy Conservation or Energy Credit. Select one, and you see links to numerous Q&As on the current topic, with a link to the related forms and occasional expert tips, meaning educational articles on the current topic. The more specific you can be when entering your search term, the better, because H&R Block’s help files are massive. In this regard, TurboTax’s Search tool works similarly.

The chat link in the lower right opens the Online Virtual Assistant, which starts an automated conversation with you about the word or phrase you entered, though content options here are limited. TurboTax’s Digital Assistant is much better, responding to more queries with actual answers. Both only support questions about the websites’ handling of form 1040, not queries about the tax code.

If you have questions about the site itself, like where to enter an item, you can call a specialist during the service’s very generous business hours. Text chat is also available. If you have actual tax-related questions (Can I write this off? Do I qualify for this?), you can connect with a tax professional (CPA, EA, or H&R Block tax expert) in multiple fee-based ways involving chat, phone, and video screen sharing, as I mentioned earlier. Other sites like TaxAct give connections to tax pros for a fee. Cash App Taxes and FreeTaxUSA do not.

Review and File Your Tax Return

After you complete all the federal tax steps, H&R Block Deluxe takes care of some additional tasks—such as creating estimated tax payment vouchers—and then provides a summary of your return. It also suggests forms you may have forgotten and lets you search for and jump to additional documents by form name or tax topic, which is very helpful if you come to the end of your return and still have paper forms or unresolved issues.

Next up is the site’s Federal Accuracy Review, which combs your return for anything that may be inaccurate or missing. If it finds something, it explains the problem and provides a Fix Issue button, which takes you to the offending screen for corrections. In my testing, it worked for most issues, though it didn’t return me to the Accuracy Review after I’d fixed the problem, like TurboTax does. I got tangled in a loop on one IRA-related entry I either had to fix or incur a penalty, and I had to back out, look for more information, and try again.

After you’ve satisfied or skipped any issues (you’ll be able to fix them later), you see a summary of your return’s key totals. Then H&R Block transfers required numbers to your state returns, helps you prepare them, and then walks you through e-filing. You can file up to three state returns.

Sound Security

H&R Block websites offer multiple layers of protection, including industry-standard web-browsing encryption technology and multi-factor authentication. Your personal data is protected and monitored 24/7. The company employs external security experts to perform audits and assess risks, and its data centers, network, and servers are housed in secure facilities.

The H&R Block Mobile Experience

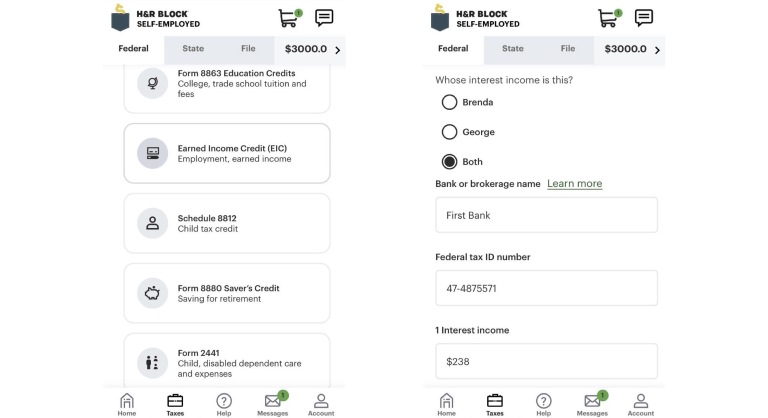

H&R Block has an Android app and an iOS app. The H&R Block Tax Prep and File app lets you file or access a return you’ve started or completed on another device. As we found last year, the mobile app does a beautiful job of replicating the desktop experience. It offers simple navigation, an able help system, and comprehensive coverage of tax topics.

Screens look like they do on the browser-based version, with a few exceptions. For example, the mobile versions display icons at the bottom of the screen, providing another path to screens and tools. If you’re accustomed to using your phone for productivity applications, you probably wouldn’t find it difficult to complete your return on your mobile device.

A Reliable Option

H&R Block is a comprehensive and solid tax preparation website. Our own testing journey through the 1040 using H&R Block Deluxe went fairly smoothly in testing, and we appreciate the ongoing changes made to the site. Whether you’re a return H&R Block customer or are in the market for the first time, you’ll find it combines exceptional preparation tools and guidance to help you get the biggest refund you can.

If you want the best tax preparation website available, though, we recommend our Editors’ Choice winner, TurboTax. This family of tax websites is more expensive than H&R Block, but it’s also superior in multiple areas, including its user experience (functionality, usability, and design), the overall tax preparation process, and help resources. For a deeper dive on our top two choice for filing this year, you can read our story on TurboTax vs. H&R Block: Which Tax Prep Software Is Best for Filing Your Taxes Online?

While you’re thinking about your own money, you should read our coverage of the best personal finance software, and if you run a small business you might take a look at our overview of the best accounting software.