A guest or a host has up to one year from the date of a stay to leave a review. However, once a review has been submitted by one of the parties, the other party has 14 days to share their review in return.

Guests can rate their stays using a five-star rating system and submit their reviews to help other travelers. The main difference from Airbnb is that hosts’ responses to reviews from guests are displayed within the review section. It comes in handy for guests to see the whole picture and get more insight into other guests’ impressions before making a reservation.

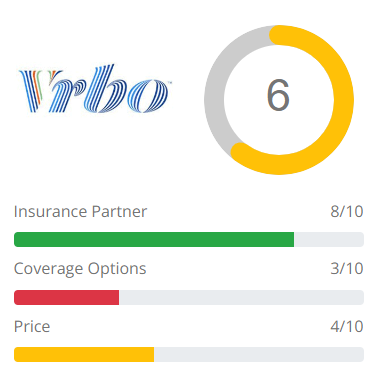

Strengths

- Reputable Insurance partner

- Good Medical Evacuation benefit

Weaknesses

- Weak medical insurance

- No Cancel For Any Reason option

- No Pre-existing Condition benefit

- High cost

VRBO Insurance protects your property rental fees against Trip Cancellation, Interruption, and several other perils.

One important feature missing from all VRBO Insurance plans is Cancel For Any Reason. If you have concerns about Coronavirus/Covid-19 interfering with your trip, VRBO’s travel insurance will not cover it unless the traveler had a covered sickness or injury. We get into more detail about this later in the article.

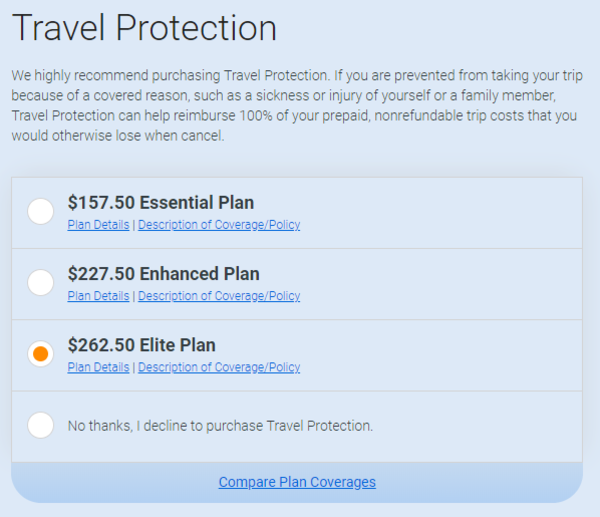

VRBO advises customers to purchase travel insurance. They offer three levels of trip insurance coverage: Prime, Enhanced, and Elite. Generali US underwrites the policy, and CSA Travel Protection administers the program and processes claims.

In this review, we only cover the VRBO insurance Elite plan because it includes all the benefits you expect to see in a robust travel insurance policy. Prime and Enhanced lack the comprehensive trip insurance benefits, so we do not cover them in this review.

In addition to a travel insurance plan, VRBO sells a damage protection program that is separate from travel insurance. It covers personal liability if you accidentally damage the property. Typically, travel insurance does not cover liability since it’s not a standard travel hazard.

However, at AARDY, we offer the Trawick First Class, which includes a $5,000 Accommodation Property Damage benefit. It provides reimbursement for direct physical damage to covered real or personal property within the unit occupied by the insured during the trip.

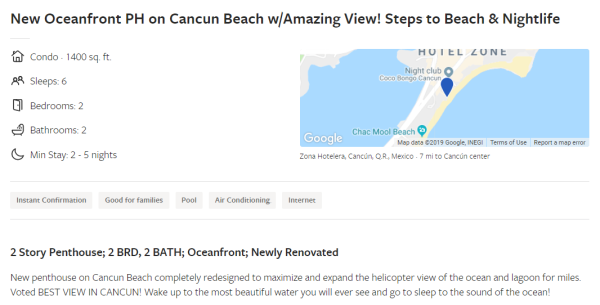

Our VRBO Booking

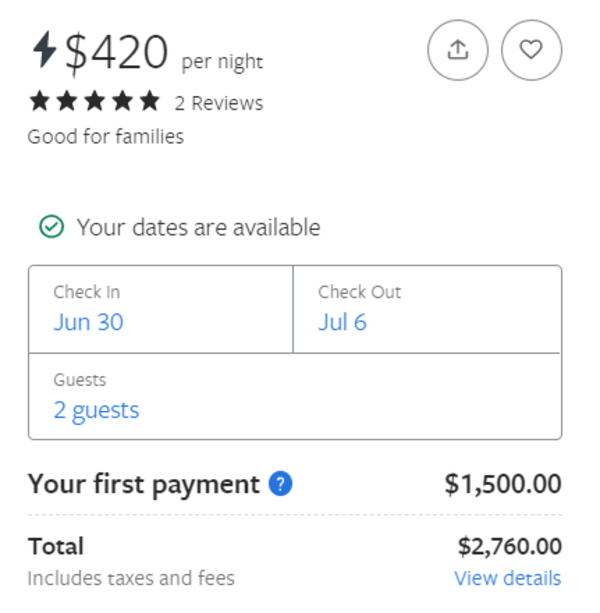

For this review, our sample couple is age 55 and 60, and they booked a beach rental in Cancun, Mexico, during the week of July 4th.

Since this is a peak travel week, the cost of the rental is $2,760. The couple also paid $740 for non-refundable airfare in case of cancellation. The total trip cost is $3,500.

If they insure the condo rental and airfare through VRBO trip insurance, the cost is $262.50. Is this a good value? Let’s find out.

Here is the offer from VRBO’s travel insurance page:

What Does VRBO Include for the Price?

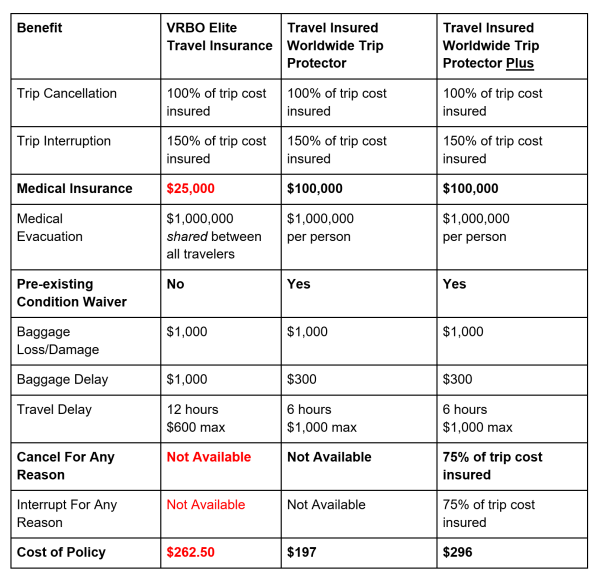

The following table compares the VRBO Insurance plan to Travel Insured International Worldwide Trip Protector and Worldwide Trip Protector Plus, both available at AARDY.

VRBO Insurance Summary

First, our VRBO travelers save 25% on travel insurance by working with AARDY and enrolling in the Worldwide Trip Protector. Not only do they save money, but they also get a much lower price for more coverage.

Second, for a few dollars more, you could get Cancel For Any Reason with the Worldwide Trip Protector Plus policy. It allows cancellation with a refund for any reason not listed in the plan, including Covid-19.

By shopping around, you will find more value and better coverage.

Cancel Your Trip – Get a Refund

Most VRBO vacationers are interested in Trip Cancellation. Since many rental reservations require non-refundable deposits and full payments, renters face a potentially massive loss.

If you cancel for a covered reason, VRBO Insurance can refund up to 100% trip cost. It permits Trip Cancellation due to:

- Unforeseen illness, accidental injury, or death.

- Inclement weather that causes complete cessation of services

- Traffic accident en route to the destination

- Hijacking, quarantine, jury duty

- Fire, flood, burglary or other natural disaster

- An involuntary layoff from work

- Theft of passports or visas

- Mandatory evacuation due to adverse weather or natural disasters

- Called to military service due to natural disaster

- Terrorism

- School extension past predefined year

- Required to take an exam after purchasing travel insurance

- Interruption of utilities at destination

- Adverse weather or natural interrupting road service

- Destination country requires vaccine or inoculation declared after buying the policy

- Notice of organ transplant match

- Notice to attend or cancel adoption proceeding

One thing we like about this policy is that it recognizes the illness, injury, or death of a service animal as a cancellation reason. We commend VRBO for offering that option.

Although VRBO insurance offers a respectable list of cancellation reasons, it does not cover any of the following situations:

- Required to work during vacation

- Employer-initiated transfer

- Business partner’s unexpected illness or death

- Natural disaster at your place of employment

- Hurricane warning at your destination within 48-72 hours of departure

- Travel restrictions imposed for a certain area by governmental authority

- Local government-ordered lockdown or shelter-in-place orders

- Travel advisories

- Travelers denied entry to the country or state

- Closed beaches, attractions, restaurants, venues and similar

- Any foreseeable issue when you bought coverage

For any of the circumstances above, you would need a Cancel For Any Reason plan. Also, since the outbreak of Covid-19, some rental providers require Cancel For Any Reason insurance on the booking. Unfortunately, VRBO travel insurance would not be suitable for that requirement.

Cancel For Any Reason

The VRBO insurance policy does not offer Cancel For Any Reason. It only covers the Trip Cancellation reasons listed in their plan.

If you want the flexibility to cancel a vacation rental, you need Cancel For Any Reason trip insurance. It helps you protect against loss from inclement weather forecasted for your entire stay, if your pet is sick, or you cannot go anywhere because of Coronavirus closures and mandates.

Several policies at AARDY offer Cancel For Any Reason. There are a couple of rules:

- Must purchase the policy within 10-21 days of initial trip payment

- Cover 100% of the prepaid, non-refundable trip costs.

- Be fit to travel on the date of purchase

- Use Cancel For Any Reason more than 48 hours before the trip start date

If you meet all of the criteria, Cancel For Any Reason will refund you 75% of your total trip cost.

In the example above, Travel Insured Worldwide Trip Protector Plus with Cancel For Any Reason is nearly the same price as the VRBO insurance without Cancel For Any Reason.

Hurricane & Weather-Related Cancellation

VRBO Insurance offers minimal weather-related protections:

- Destination uninhabitable by fire, flood or natural disaster

- Mandatory evacuation

- Weather closes roads for six or more hours

- Water, electric, sewage or gas service at rental shut off

On the other hand, Worldwide Trip Protector specifically covers hurricanes as a cancellation reason if:

- Your trip destination is under a hurricane warning issued by the NOAA National Hurricane Center

- Cancel less than 48 hours to the departure date

- The policy has been in force at least 14 days before cancellation

Family Emergency – End Your Trip Early

VRBO Insurance has Trip Interruption. Trip Interruption refunds up to 150% of the unused portion of total trip cost if you experience a covered interruption. The benefit also reimburses you for the extra cost to travel home early.

Typically, a covered Trip Interruption would be for the same reason as a Trip Cancellation, but it occurs during your trip, not before.

Worth noting, if you must return home for a reason not covered by the policy, VRBO trip insurance will not compensate you for the loss. In that case, you would need Interruption For Any Reason.

Suppose you rented a house in the British Virgin Islands for two weeks. After three days, the local government expelled US travelers due to the risk of spreading Coronavirus. Travel insurance does not cover this scenario, but Interruption For Any Reason would.

If You Fall Sick or Injured on Your Trip

If you book a VRBO in Florida during February, you probably would not think Medical Insurance is essential. But if you have a Medicare or private health care plan that does not let you see any doctor in the country, then Travel Medical Insurance comes in very handy. Extra Medical Insurance in the US is helpful to cover out-of-pocket expenses like copays, deductibles, and coinsurance.

No one goes on vacation expecting to get hurt or fall ill. So, we always recommend travelers leaving the US take at least $100,000 Medical Insurance, $250,000 Medical Evacuation, and a Pre-existing Condition Waiver whenever possible.

VRBO Insurance includes $25,000 on the Elite plan. Neither of the other VRBO insurance policies offers Medical coverage.

Are Pre-existing Medical Conditions Covered?

Since the most common reason for cancellation is due to the health of a traveler, your travel insurance policy should cover Pre-existing Medical Conditions. If it does not cover them and you must cancel due to a health reason, the insurance company may deny a claim for cancellation or medical treatment due to a Pre-Existing Condition.

VRBO Insurance does not provide a Waiver of Pre-existing Medical Conditions. This means if in the 60 days before buying the policy, you had a treatment, test, medication change, new medication added, or your doctor recommended a treatment or test you have not completed yet, the policy does not cover you for Cancellation, Interruption, Medical treatment, or Medical Evacuation.

You would be exposed to a 100% loss if you had to cancel due to a Pre-existing Condition that was recently changed or diagnosed.

If you have a medical condition older than 60 days that is stable, under control with medication, and unchanged, then it would be covered.

However, most policies at AARDY include a Waiver permitting the policy to cover Pre-existing Conditions. Then, it would not be subject to the 60-day Look Back Period described above.

To qualify for the Waiver:

- Purchase a policy offering a Waiver within 14-21 days of your initial trip deposit/payment

- Cover 100% of prepaid, non-refundable trip costs

- Be medically fit to travel on the date of insurance purchase

Medical Evacuation – Domestic and International

Medical Evacuation insurance is useful within the US and abroad. If you experience a critical injury or illness, the Medical Evacuation benefit transports you to the nearest hospital. Once you are stable, it brings you back home for further treatment.

Costs for Medical Evacuation can vary. It might be as simple as a ground ambulance a few miles away, or as complicated as an air rescue in the Rocky Mountains.

An air ambulance equipped with ICU machines and monitors, as well as a medical team, may cost $15,000 to $25,000 per hour.

Although VRBO insurance covers up to $1 million of Emergency Medical Evacuation benefits, the policy splits that amount among all travelers, rather than per person. Shared limits are unusual for travel insurance.

AARDY recommends you take at least $100,000 Medical Evacuation while away from home in the US, and $250,000 Medical Evacuation when traveling abroad.

VRBO Does Not Deliver Value

We would not recommend any VRBO insurance option because none of them offer a Waiver of Pre-existing Conditions. We advise anyone taking out travel insurance to buy a policy with a Waiver. It closes coverage gaps in Cancellation, Interruption, and Medical treatment.

VRBO insurance has $25,000 Medical Insurance, which is sufficient for travel within the US, but inadequate for overseas treks. This benefit level makes it a poor deal for senior travelers. We recommend a minimum of $100,000 Medical Insurance per person.

While VRBO travel insurance policy includes a respectable list of cancellations, many situations leave you at risk. VRBO fails to offer a Cancel For Any Reason option, which is essential for pandemics, potential wedding cancellations, sick pets, travel advisories, and anything else not covered by the policy.

Although VRBO offers a $1 million shared Medical Evacuation benefit, it is still useful.

For a similar cost to VRBO, you could get a CFAR plan through AARDY that offers significantly more benefits.

Get an Insurance Quote For Your VRBO Rental

When you shop at the AARDY Travel Insurance Marketplace, you can compare quotes and policies from dozens of the nation’s top-rated travel insurance carriers.

We offer seniors the best travel insurance value for their money. We will answer your questions and give reliable advice on the best VRBO travel insurance for your trip.

Speak with one of our licensed travel insurance experts at 650-492-6298, by email or by live chat.

Safe Travels!